By: Karan Dewan

Raising capital for your business is not easy. In fact, it is one of the most challenging things you can do in business. There are so many factors involved and so many different types of investment options.

Most startups fail to raise investment capital because they fail to understand what investors are looking for and what makes a business worth investing in.

If you are in the start up ecosystem you will be aware of the culture surrounding startup funding and how it is perceived within the community. Most founders think that raising money is more prestigious then running a successful company.

In this article we are going to explain everything there is to know about raising capital for your startup, what you should know and how to increase your chances of getting funded.

Let’s get started…

1. What stage are you at?

There are 3 main stages of a business looking to raise capital.

Idea

Proof of concept

Growth

Idea

Henry Ford once said “anyone who’s ever taken a shower, has had an idea for a business. It’s the person who does something about it that makes a difference.

Ideas are a dime a dozen, and investors do not invest in “ideas”.

If you believe in your idea and believe it has huge potential as a business, start working on it, even if it is small steps every day. This does not mean quitting your day job, you can take small steps in taking your idea to something tangible without spending too much money or going at it 100%.

This does not mean investors do not invest at idea stage at all, however to raise investment at this stage investors are expecting you to have a deep understanding of your business, your product, your market, your competition, expertise in the industry and a great team to execute on the plan.

You should be able to articulate why investing at this stage is a great opportunity for investors, not why you need the money to pursue your dreams. Investors are only investing to maximise their returns, they are speculating on you and your ability to return as much capital as possible.

Proof of concept

If you are at this stage, it means you have managed to build the foundations of your business and are proving the viability of the concept.

Investors like to invest at this stage as it shows you have taken the leap and backed your ability by taking some risks.

It is also early enough that they can speculate on a decent return if the company does well.

At this stage you are trying to prove that the concept works even if you are working with low metrics to evaluate on. You don’t need to have a lot of sales, you just have to prove the concept works and can be scaled.

For example.

Let’s say you run a SAAS businesses.

You charge $40 for a year subscription.

Using google Adwords you spend $100 attracting targeted visitors to your site.

At $1 per click you have attracted 100 visitors to your site over 5 days.

Out of the 100 visitors 3 subscribed for the membership paying $40 each and $120 total revenue.

This shows a conversion rate of 3% and a slight profit.

Investors can look at this information and see that if you were to scale to 2000 daily unique visitors through free SEO traffic at a 3% conversion rate you are looking at 60 daily paying subscribers with a total of $2400 in daily revenue. This can also be scaled by increasing brand awareness through PR allowing more targeted visitors to your site.

The above information shows investors that the concept is scalable, and you have only spent $100 proving the concept.

Growth

Growth stage funding usually comes after a few rounds of seed funding have been made. Typically growth stage funding will be known as a series A or series B round.

This is a more complex funding round as you will be raising between 1-5million dollars.

In order to reach for this level of funding you should be able to meet the following criteria;

You have proven the concept beyond a few metrics and are able to demonstrate there is huge scalability with this business.

You have proven there is an appetite for your business in the market and you can foresee long term growth over the next 5-10 years.

You are generating significant sales.

You have proven that you are solving a problem which affects many people.

You are able to protect your IP in some way so that it is not easy to replicate.

You and your team have the right knowledge and expertise to scale this business exponentially.

You can prove there is an exit strategy in place so investors can realise their returns within 5 years.

This round of funding usually comes 3-4 years into the life of a start-up, as you will have enough time to prove the concept as mentioned above.

2. The Business.

Before seeking investment and before asking someone to invest their hard-earned money into your business, you should ask yourself the following questions.

Does this business require external funding?

Have I done everything I can by myself before seeking investment?

Is this a good investment for an investor, or am I experimenting on someone else’s dime?

Will the funds raised get me to the next stage of the business?

Do I have anything unique that can’t be easily copied?

Is the valuation fair and realistic?

Asking yourself the above questions will allow you to see the oppertunity from the investors point of view. If it doesn't make sense to you it wont make sense to investors.

3. The Team

Having a great team is one of the biggest deciding factors for investors.

Many institutional investors are now offering investments to strong teams before an idea for a business has even been thought of.

If you are a solo founder you will really struggle to get an investment. If you are a tech guy you should go find a business guy, if you are a marketing expert find yourself a tech expert. Ideally you want to have 2-3 founders including yourself.

Why is so much enthesis put on strong teams?

Investors know how much work goes into building a business and they know one person can’t do it all.

Research has shown, businesses with 1 founder have a much higher fail rate than businesses with 2 or more founders. For this reason, investors like to play the odds and back what they know has worked in the past.

Investors are not keen on a team of people who are employed by the company. They want 2-3 members of the team who have significant equity in the business.

So, having 1 person who owns 100% of the company and 5 employees is not as good as 3 people who own 33% each.

4. Company Deck.

Having a company Deck allows investors to see all the information you want them to see within a contained document.

A good company deck should contain the following information.

Company and contact details.

A brief summary of the business.

Explanation of the market and opportunity.

Details of your competitors, how you’re different and why you will exceed them.

Information regarding the metrics of the business.

A clear exit strategy.

Forecast predictions.

5. Valuation

Valuation is one of biggest reasons a deal does not go through.

Founders put a lot of value on their time, effort and sweat equity that goes into building a business.

Investors on the other hand, do not care about any of that. Investors put more value on their money and believe their money holds more power in this scenario.

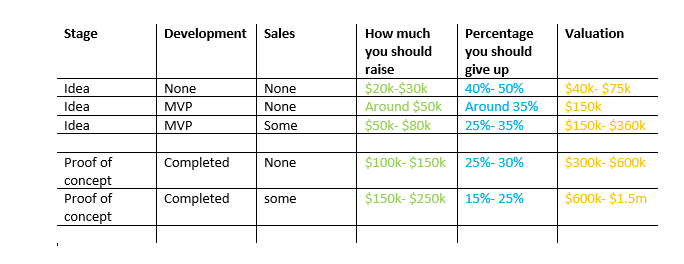

Below we have put together a rough guideline on how to value your business and how much you should look to raise. We are only looking at Idea stage and proof of concept stage start ups at this point as growth companies have too much variance.

Above are estimates only, and there many variances involved. Check with a financial advisor before seeking investment and giving up equity in your business.

6. Types of investors

Not all investors are the same, they don’t all have the same investment criteria or investment goals. Before seeking investment, you should establish the type of investor that would best suit your goals.

We have categorised some investor types;

Low level, passive. This is someone who would likely invest along side a syndicate or through crowdfunding. This type of investor is not looking to run the business with you and is investing to hold their position until an exit occurs.

Mid level, active. This is someone who is looking to join a team and bring capital to the table. This type of investor is someone who may have $50k- $100k in savings and wants to leave their day job in pursuit of a more challenging and rewarding venture.

High level, passive. High level investors tend not to be very active in the running of the business. They are likely to have busy lives and do not have the time to be part of the business. They will likely invest and wait for an exit event.

Philanthropist. Not all investors are investing purely for financial reasons. Some investors invest because the business or idea resonates with them or it is something they are passionate about. There are many investors who invest in minority only or women only businesses to increase diversity within entrepreneurship.

We hope this article has been useful to you. Now that you have all the information, start connecting with investors by clicking here.